E-Commerce Customer Segmentation

- Anang Hendro

- Nov 17, 2022

- 1 min read

Updated: Jan 24, 2023

Tools : Google Colab

This project was part of RevoU's individual assignments as a practice of doing end-to-end analysis using Python and conducting clustering analysis, which generate customer segmentation for targeted marketing

Background Information

Gustavo just started an e-commerce startup based in Brazil that recently opened an online website to sell their product. Fortunately, Gustavo is launching their website when COVID-19 hits and making them grow faster than ever. However, Gustavo is still not using targeted marketing which hurts their marketing budget as only a fraction of their user comes back to their website

Objective

Create user segmentation for targeted marketing that fits the marketing budget of the company

Analysis Method

Using K-Means Clustering to create user segmentation. Determine four cluster of users using elbow method and silhouette score

Insights

From the descriptive analysis and EDA of the dataset, we can find several insights

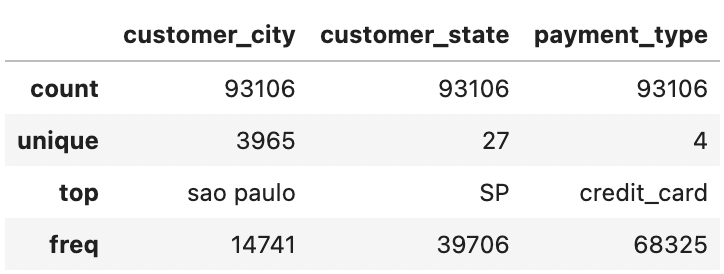

There are 93106 transactions on the dataset, which consist of transactions from 27 states and 3965 cities with 4 different payment types

The average mode of payment sequential is 1, which means that most customers usually only use one type of payment type.

The mode of payment installments is 1 meaning that most customers usually only pay in single installments

The average payment value is 110$

The city with the most transactions is Sao Paulo with 14741 transactions.

The state with the most transactions is SP with 39706 transactions

The most preferred payment type is a credit card with 68325 transactions

The number of orders generally increases throughout the year. In 2017, the number of orders generally increase throughout the year, peaking in November. The number of orders jumped down in December 2017. In 2018, the number of orders is stable without extreme increment/decrement. The number of orders is noticeably higher than the previous year with January's order being very similar to orders of November 2017 and keeping performing well for the upcoming months

The highest number of orders occurred on Monday and perform better on weekdays rather than the weekend. The number of orders keep decreasing as the days progressed. These trends could mean that weekdays order generally happens because customers usually want to receive the order in the same week or assume that delivery time is shorter because it is within the same week. Another possible reason is that on the weekend the customers could be doing activities other than browsing and ordering the products.

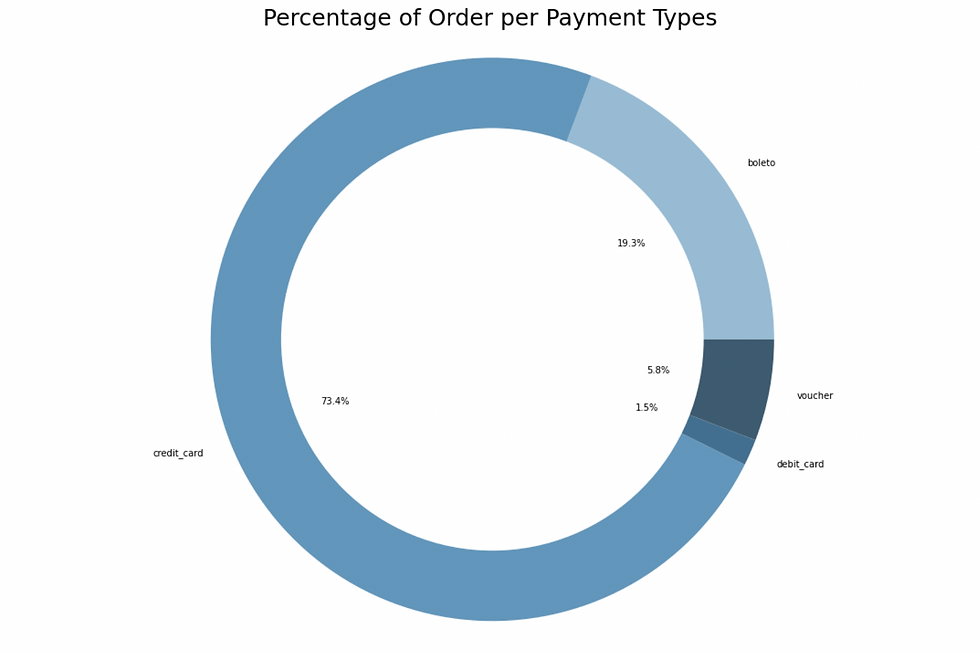

Percentages of orders per payment type show that the highest payment type of choice is a credit card with 73,4%, followed by boleto (19.3%), voucher (5.8%) and debit card (1.5%). With these findings, the company could make special promotions or discount for credit card payment to keep the usage of credit card payment at a higher percentage or even increase it.

Clusters Profile

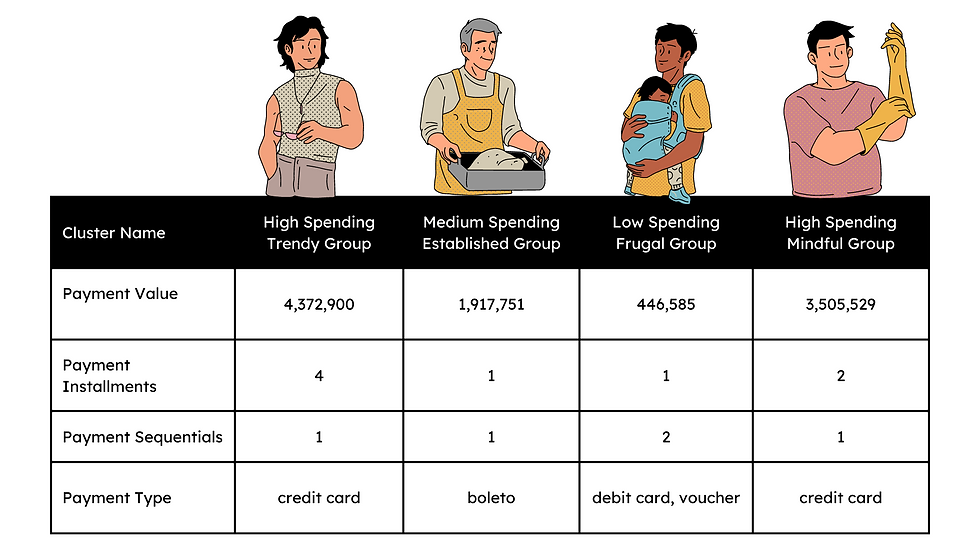

Cluster 0, consists of customers with high payment values but prefer longer installments as seen on the mean of the payment installments. We could assume that people in this cluster tend to buy expensive things such as the newest gadgets, trendy clothes or viral skincare, therefore they choose to have longer installments as it is hard to pay such big money in a single time. With that assumptions, we could say that this specific cluster consists of young people or people in their early careers who need to be updated with the trends (need another dataset to confirm). Cluster 0 prefers single sequential payment using credit cards as is it possible to have long-term installment plans. Hence, we call these cluster as "High Spending Trendy Group"

Cluster 1, consists of customers with medium payment values who prefer single installment payment. We could assume that people in this cluster are adults or older adults who had established jobs/careers because they could afford to spend quite high payments in a single payment. They could be purchasing stuff for their own space e.g furniture, home decor, etc, or even for their hobbies (need another dataset to confirm). They pay with a single sequential using boleto. Boleto is commonly used in Brazil by older people who feel that boleto is safer and more convenient than banking payments such as credit/debit cards. We call these cluster as "Medium Spending Established Group"

Cluster 2, consists of customers with low payment values who prefer single installment payments. This cluster specifically tends to pay in double sequential payments using debit cards combine with vouchers. We could assume that people in this cluster only purchase cheap items or items that they specifically need to buy e.g groceries, food, etc, considering their payment choices. This cluster could consist of people with lower incomes or people with frugal life as they preferred to split the payments to different methods in order to portion their spending or get lower prices. We call these cluster as "Low Spending Frugal Group"

Cluster 3, consists of customers with high payment values with double installments payment with a preferred single payment type using a credit card. This cluster shows similarity with Cluster 0 with the only difference being shorter payment installments. With that being said, we could assume that they had similar customer types with a tendency to purchase expensive products. However, shorter payment installments could mean that financially they're doing better than people in Cluster 0. They still want to keep up with the trends but also to portion their spending by splitting the payment. We call these cluster as "High Spending Mindful Group"

Recommendations

For 'High Spending Trendy Group' and 'High Spending Mindful Group' the company could push more trendy items such as gadgets or fashion items to them specifically and offer various installment payments as they usually spend in higher values.

For 'Medium Spending Established Group', the company could offer a special discount/promotion code using boleto as all of the people in this cluster only use boleto

For 'Low Spending Frugal Group', the company could offer special prices or discounts on groceries or daily products. The company could also hold special event/promo where people could buy products in bundles with special prices and give promos within their chosen payment types (debit cards and vouchers)

Comments